by German | Feb 28, 2020 | Home Insurance, Homeowners Insurance, Insurance Tips

Research suggests revenue from short-term vacation rentals will surpass the hotel industry in 2020. In fact, Airbnb reports that on any given night, there are 2 million people staying at one of its properties. If you’re looking to make extra income listing your space...

by German | Feb 21, 2020 | Business Insurance, Commercial Insurance, Small Business Insurance

The Federal Emergency Management Agency (FEMA) reports that 40 to 60 percent of small businesses never recover and re-open their doors after a disaster. It is in the best interest of your business to maintain both adequate insurance coverage and a disaster recovery...

by German | Feb 14, 2020 | Home Insurance, Homeowners Insurance

Homeowner’s insurance is directly linked to the value of your home, and the only way to be confident you have the coverage you need is to be transparent about improvements you’ve made to your property over time. Here’s what to consider before, during, and after a home...

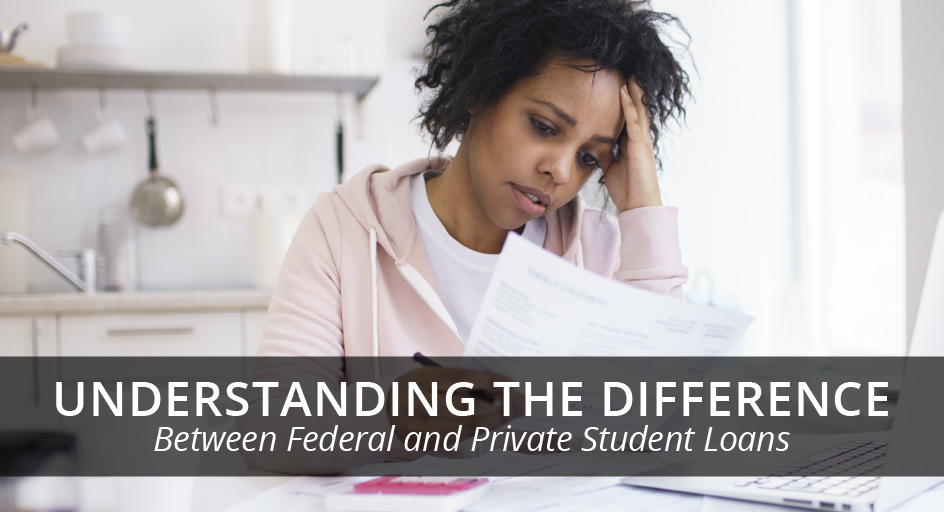

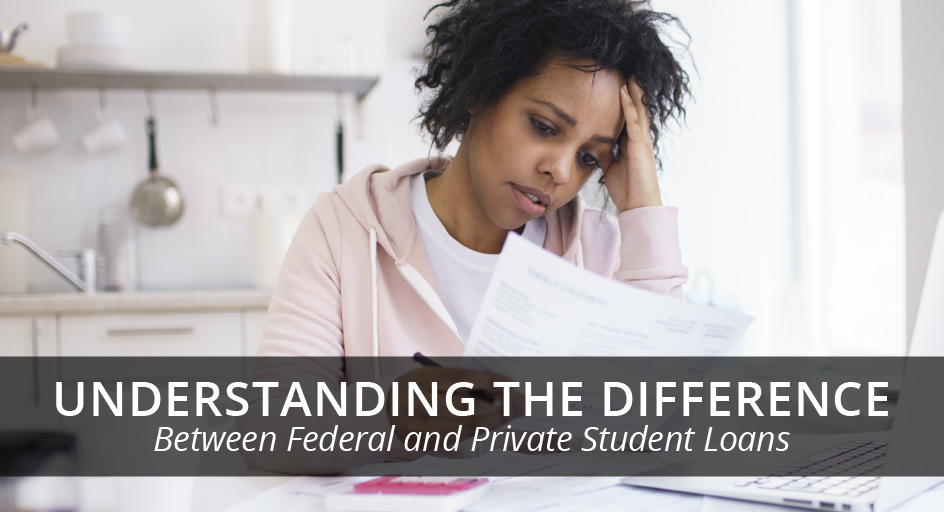

by German | Feb 7, 2020 | Life Insurance

Debt happens. When it comes to pursuing a post-secondary education, loans can be an important means to an end. But before you choose between federal and private loans (or choose a combination of the two), you need to understand the difference and the long-term effect...

by German | Jan 24, 2020 | Home Insurance, Homeowners Insurance, Reduce risk, Risk Management, Winter tips

Our homes protect us from the most severe winter weather, but our homes are not always protected from the same elements. Snow, ice, and even simply freezing temperatures can have drastic effects on our homes and the parts that make them work. As the temperatures drop,...