by German | May 8, 2020 | Home Insurance, Homeowners Insurance, Risk

Backyard fun may come at a cost, but that doesn’t mean you should avoid splurge purchases like trampolines and treehouses altogether. Ultimately, it’s a family decision, partly based on feedback from your pediatrician on risk vs. benefit, and partly based on whether...

by German | Mar 27, 2020 | Home Insurance, Homeowners Insurance

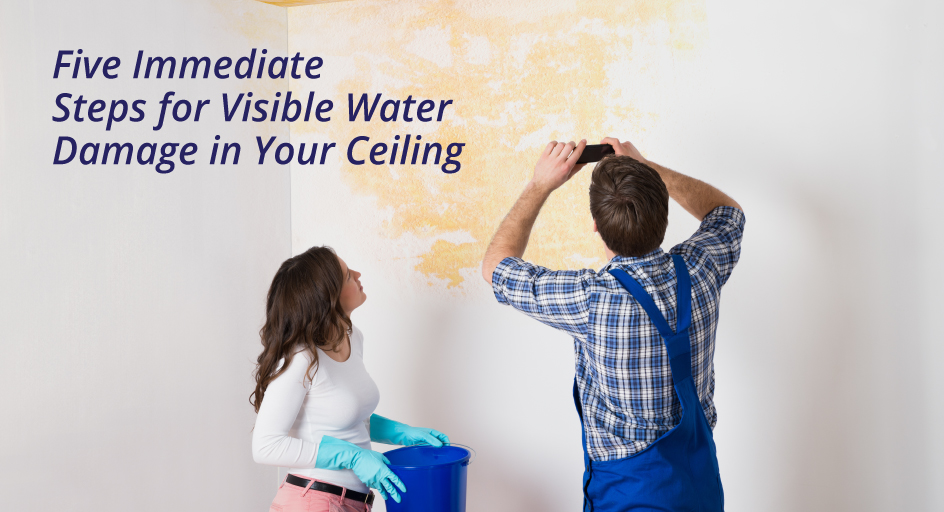

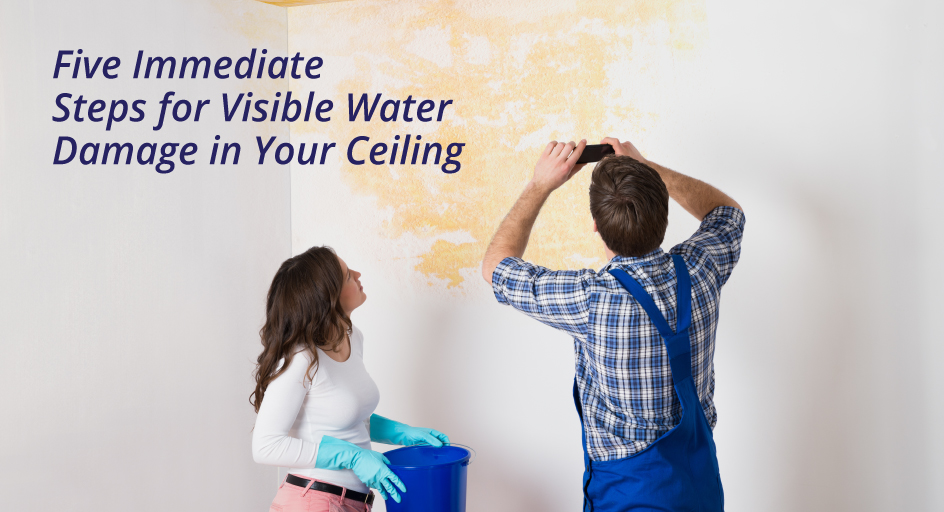

It’s a daunting moment when you look up to find a puddle in a light fixture or a growing water stain on a ceiling. Here’s what to do to minimize the damage and get help for a repair. Clear and protect the area beneath the stain. Move furniture and valuables, then lay...

by German | Feb 28, 2020 | Home Insurance, Homeowners Insurance, Insurance Tips

Research suggests revenue from short-term vacation rentals will surpass the hotel industry in 2020. In fact, Airbnb reports that on any given night, there are 2 million people staying at one of its properties. If you’re looking to make extra income listing your space...

by German | Feb 14, 2020 | Home Insurance, Homeowners Insurance

Homeowner’s insurance is directly linked to the value of your home, and the only way to be confident you have the coverage you need is to be transparent about improvements you’ve made to your property over time. Here’s what to consider before, during, and after a home...

by German | Jan 24, 2020 | Home Insurance, Homeowners Insurance, Reduce risk, Risk Management, Winter tips

Our homes protect us from the most severe winter weather, but our homes are not always protected from the same elements. Snow, ice, and even simply freezing temperatures can have drastic effects on our homes and the parts that make them work. As the temperatures drop,...